Global growth and wealth has increased by vast amounts in the last few years. According to Knight Frank, the number of ultra-high-net-worth individuals* in Asia rose to just under 180,000. In Singapore, the number of high-net-worth individuals** and ultra-high-net-worth individuals in 2021 were over 525,000 and 4,200, respectively.

With this global growth, families are looking to be more involved in their own financial asset management. With concerns about success planning and wealth preservation on the rise, interest in family offices have also increased: the number of family offices has increased by over ten times from 2017-2022. Family offices are usually set-up with a corresponding family fund, leading to these more efficient and transparent, lean structures.

Family offices’ usually take over administration and daily management of a families’ assets. Family offices provide professional wealth management and business governance, as well as allowing for greater involvement with different generations, facilitating intergenerational continuity, ensuring strong family and business governance framework.

*ultra-high-net-worth individuals refer to those worth over USD$30 million in assets

**high-net-worth individuals refer to those worth over USD$1 million

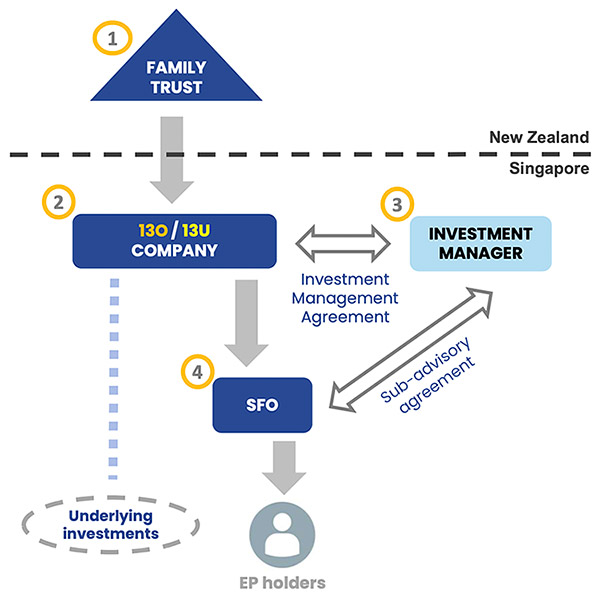

At Premier Fiduciary, our focus is to provide a tailored solution that achieves MAS (Monetary Authority of Singapore) approval of a 13O/13U company that will have minimal tax on private banking assets, dividends, and interest income. Our specialized structures utilize MAS approved tax incentives to ensure no taxation on capital gains, or income. These structures will allow for the custodization of assets safely in Singapore with major international banks, hassle-free set-up of company structures, accounting, and management. In certain cases, residency in Singapore for family members and/or close staff.

Many families choose to set up SFO’s in Singapore due to a myriad of reasons. This includes its strong financial and legal infrastructure, a high quality of life, fully compliant legal framework, business and political stability, pools of experienced wealth management professionals, a transparent and clear tax regime, and its advantageous location within Asia.

These SFO’s will be owned by a Singapore company with a 13O or 13U tax incentive. Once approved by the MAS, the SFO is allowed to manage its own money. Two major benefits lie in the investors’ ability to receive gains through the SFO, and living, working, and travelling in and out of Singapore on an Employment Pass.

At Premier Fiduciary, we know every family is different, and will require different structures and services. We offer bespoke solutions and structures, tailored to your needs.

The following diagram illustrates one potential solution, setting up a 13O Singapore company with underlying single-family office under a New Zealand trust:

Interested in working with us? Contact us today and we’ll get back to you the soonest.