Private clients often require bespoke solutions that span multiple continents. At Premier Fiduciary, our private client unit leads our engagement with key intermediaries, including private banks, family offices, accounting and legal firms and independent financial advisers. Our aim is to become a strategic partner of choice in delivering unique trust and fiduciary solutions. Our services are aimed at high net worth individuals, and focus on property holdings in the US, UK, and other jurisdictions as well as commercial and private banking.

Our private client services incorporate a deep understanding of the intricate, customized, and sophisticated strategies necessary for effective wealth management. Premier Fiduciary’s experienced team of wealth management professionals design and deliver tailored solutions. We keep away from the business practice of 'products', knowing the varied nature of jurisdictional requirements across the world. We understand and assess the different requirements from different jurisdiction such as Asia, Europe, African and Latin America.

We harness this knowledge to offer a broad range of solutions, among which are company structures, trusts, foundations, property holdings, specialized investment funds and many other solutions. Our comprehensive services cover every key aspect of private wealth management, including estate planning, inheritance, asset protection, foreign investments, including currency and exchange controls, political risks and philanthropic requirements.

We offer a broad range of estate planning products designed to satisfy individuals seeking to establish a succession plan, while simultaneously providing tax minimization or tax deferral arrangements for individuals and corporations alike. Premier Fiduciary proactively develops new methods and solutions for clients to minimize the impact of changing tax legislation. Premier Fiduciary's solution-driven focus results in a continually evolving and diversified range of products.

We facilitate property holdings in the U.S., U.K., and other jurisdictions. Property Holdings are a limited liability company that is tax exempt and used to hold property, reduce liability, and manage assets. These companies are tax-exempt and located in jurisdictions with no capital gains tax, giving our clients better outcomes and benefits. However, we also understand the importance of local situs taxes, such as capital gains tax in the U.S., stamp duties in Singapore, Hong Kong, and the U.K., and ATED in the U.K.

Premier Fiduciary also leverages existing close relationships with major partners like Knight Frank, and Douglas Elliman to set up structures to own properties, as well as facilitate transactions of residential, commercial and investment properties in the United Kingdom, the United States, and across Asia. Premier Fiduciary also has experience with property holdings in the U.S. with respect to condominium ownership.

We consult and apply for the Global Investor Programme ("GIP") on behalf of our clients with pre-existing businesses and/or entrepreneurial experience who wish to obtain Permanent Residency ("PR") in Singapore.

The GIP is one of Singapore’s government initiatives to attract wealthy individuals and families from around the world to settle and invest in Singapore. The Programme offers a fast-track immigration process with a range of benefits to successful applicants, like PR and tax exemptions. It also aims to connect investors with the Singapore business community, helping them establish connections in the country.

Please contact us if you are interested in the GIP.

In the private aviation market, ultra-high net worth (UHNW) individuals expect certain levels of privacy and luxury during their frequent and extensive travel. Private aviation by means of outright ownership is an efficient and cost-effective solution to their busy schedule that spans the globe. Premier Fiduciary provides our clients with tailor-made solutions with regards to registration, asset administration, corporate structuring and service, accounting and payroll, aircraft financing, customs, VAT, and tax compliance services in relation to aircraft ownership, acquisitions, leasing and sales.

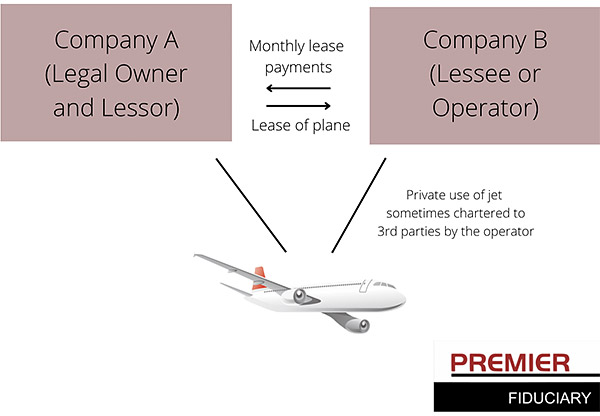

The aviation industry is host to many regulations, intended to protect both customer and owner. Selection of structures becomes dependent on the aircraft type, its use, VAT, as well as other factors. Registering your private jet through a company protects your assets, allowing your firm to more effectively manage the asset. Corporates also tend to set up special purpose vehicles to hold aircraft, and lease them to other companies within their group. Premier Fiduciary is experienced and well-positioned to guide you through setting up a company structure that suits your needs.

Private aircrafts must be registered to operate. Jets must have a national identity, with supporting evidence of registration through the country’s registry. This grants the aircraft benefits of both traffic and transit rights in the country. Aircraft can only be registered in one country. Premier Fiduciary can register your aircraft for you in the Cayman Islands, Singapore, Hong Kong or USA. We will also facilitate introductions to operators in the necessary jurisdictions and we are experienced in Indonesia, Singapore, Thailand, India and Hong Kong. Operators are a crucial component in these structures, as they will maintain the planes, and will depend on regulatory regimes, and clients’ needs.

During lay time, many beneficial owners choose to charter their aircraft to third parties. To do so, their aircraft must be operated by a management company that holds an Air Operating Certificate (AOC). This means ultimate beneficial owners can off-set operating costs with charter fees. Premier Fiduciary can also work with banks and funds that specialise in financing planes, to reduce the entry level cost to purchase the aircraft. Premier Fiduciary can further connect clients with international managers, operators, and AOC holders. Premier Fiduciary is well-positioned to set up the company and guide you in regard to all the intricacies in setting up a complex operation.

Here at Premier Fiduciary, we recognize all clients are different, and require unique solutions to their challenges. The following diagram illustrates one structure in relation to plane holding we could implement or further personalize for clients.

Premier Fiduciary will also assist with financial administrative services. This includes: company formation, corporate services and company administration. We will also provide bookkeeping, statutory accounts preparation, corporate secretarial service, tax compliance, import and export as well as payroll and HR management.

Our Services include:

Assistance with acquisitions, lease and sale

Assistance with financing

Registration of aircraft

Setup and administration of owning companies

Financial administrative services

VAT compliance, import and export services

Assistance with our global network

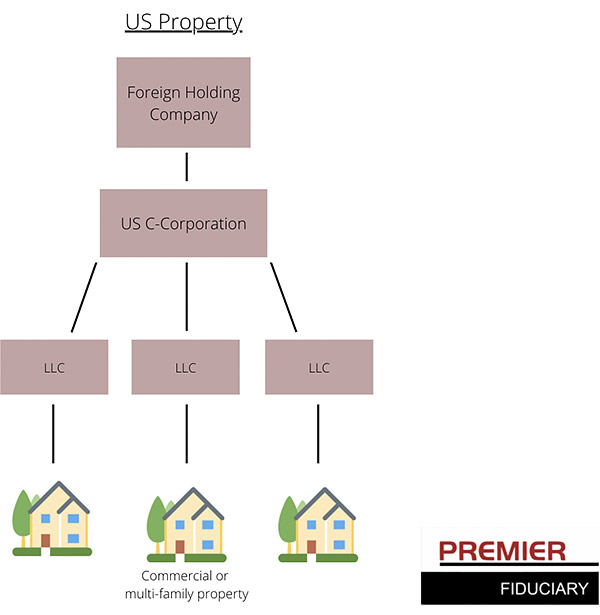

Premier Fiduciary has extensive experience setting-up vertical structures hotels, commercial and multi-family real estate, across US, UK, Canada, Australia, Hong Kong, Singapore and Thailand. We can assist our clients with tax structuring, accounting, and tax filing and overall coordination with operators, banks, and lawyers.

Our structures provide multiple benefits including inheritance tax benefits, a fixed tax rate, and mortgage deductions, income tax efficiencies, and operational and tax efficiency.

For example, due to the UK’s sliding tax rates, utilizing a limited company to hold and/or purchase property ensures a fixed corporate tax rate. For private owners, the sliding tax rate can reach up to 45%, depending on income. The corporate tax rate, however, is set at 19% (to increase to 25% by 2023). With a limited company, mortgage interest is treated as a business expense, and may be deducted before paying corporate tax.

Premier Fiduciary can also set-up hotel holdings for UK hotels under a double UK structure. This structure utilizes limited companies for hotel holding purposes, and reduces risk, offers better tax rates and lending benefits. The structure will ensure hotel ownership through one UK entity, and operational management through a separate UK entity.

The following diagram is an example of a basic structure that may be customized to fit your needs. Example structure for holding US property:

Premier Fiduciary will assist with all services necessary for your company to function. This includes accounting, bookkeeping, tax returns, registered office and company secretarial services, where necessary.

Interested in working with us? Contact us today and we’ll get back to you the soonest.